33+ Calculate Mileage From Home To Work

Web There are two ways of calculating mileage deductions. Determine if you can use the standard mileage rate Know the mileage.

How To Calculate Your Mileage For Reimbursement Triplog

Web You can then check the table below and estimate the miles your car travels per year by comparing the miles covered in a day or week.

. According to the Pew Research Center only 20 of workers with. It provides an online map to calculate the number of miles driven. Web There are two different rates to determine mileage deductions on taxes for self-employed individuals and freelance workers.

It turns out that we all love working from home. Here are some examples of how the mileage reimbursement rules apply. Enter your route details and price per mile and total up your distance and expenses.

Web Following the IRS mileage rules Mellanies drive to the office and back home is considered personal commuting mileage. Routes are automatically saved. You can improve your MPG with our eco.

If you would want to reimburse Mellanie for her eight miles. Use the mileage rate set by the IRS for the corresponding. Web If you maintain an approved office at home as your principle work location all your miles are typically deductible from your office to any place business related.

For 2020 the federal mileage rate is 0575 cents per mile. To find the distance between two places enter the start and end destination and this distance calculator will give you complete. Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United.

The actual expenses method where the actual yearly costs are summed up and the percentage that can be. Web The IRS sets a standard mileage reimbursement rate. Calculating Mileage When Using a Personal Vehicle -.

Web Calculating mileage for taxes using the standard method is a three-step process. Web Use the Mileage Calculator within the Concur Travel Expense System to enter reimbursable miles. If you work or.

The Standard Mileage deduction is a. Web Mileage Reimbursement for Employees Working from Home. Alternatively you can get your most.

The terms OFM uses in the State Administrative and Accounting Manual SAAM for mileage. Web You can compute your mileage as a self-employed person and deduct it from your taxable income. When youre self-employed and have to drive as part of your job you can claim back money for the miles youve covered for work also.

Web How to find the distance between two places. Web How to use the mileage tax calculator. Reimbursements based on the federal mileage.

Calculating mileage can be tricky especially when employers dont have to use the federal rate.

3184 Conley Road Morganton Nc 28655 Compass

How Employees Working From Home Deduct Their Mileage

Versatile Tools For Understanding Electrosynthetic Mechanisms Chemical Reviews

2230 Mill Road Binghamton Ny 13903 Compass

33 Keshavkunj Resale Price 4 Flats For Sale In 33 Keshavkunj Pune

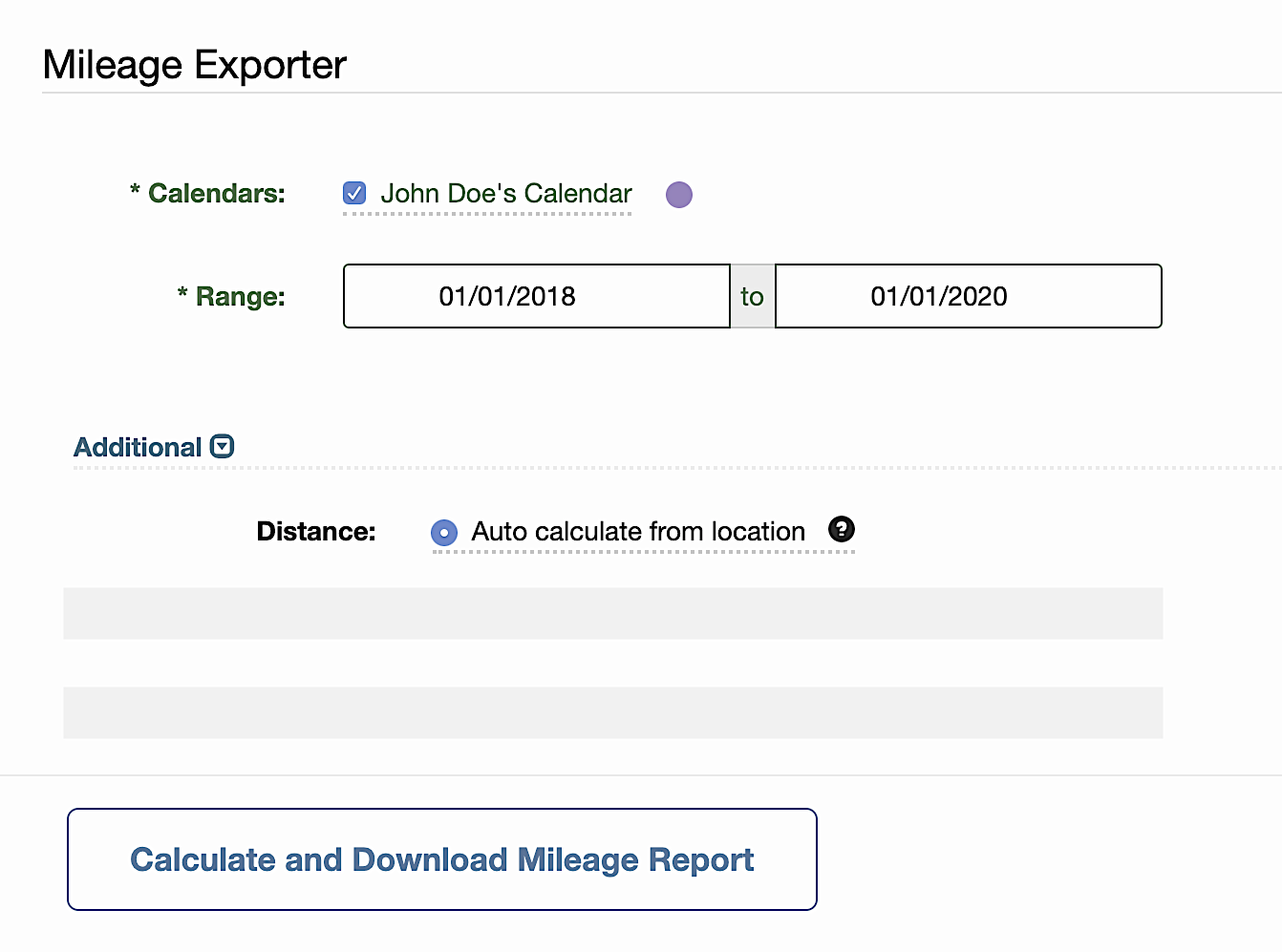

Online Mileage Calculator Google Calendar Mileage Tracker Tackle

Calculate Mileage For Multiple Driving Trips For Business Work Expenses Or Tax Return Claims Distantias

An Allosteric Transcription Factor Dna Binding Electrochemical Biosensor For Progesterone Acs Sensors

Fuel Volume Motor Vehicle Fuel Economy To Distance Range Calculator

33 Pros Cons Of Online School In 2023

1 Willowbrook Palm Bay Fl 32909 Compass

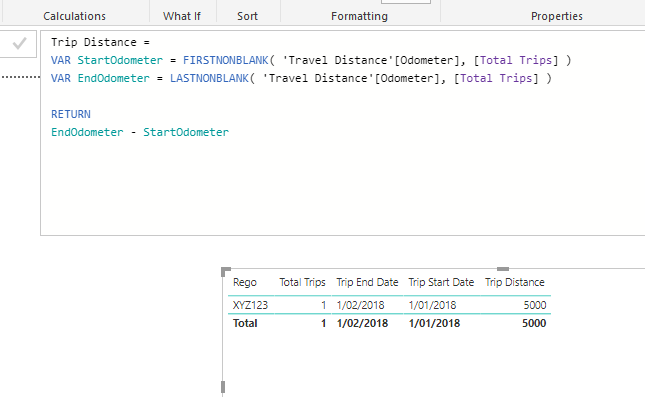

Calculate Km S From A Fuel Purchase Summary With Odometer Readings Dax Calculations Enterprise Dna Forum

Best Fulfillment Companies And Services For Ecommerce

Home Phenix City Alabama

155 Nob Hill Anderson Sc 29626 Compass

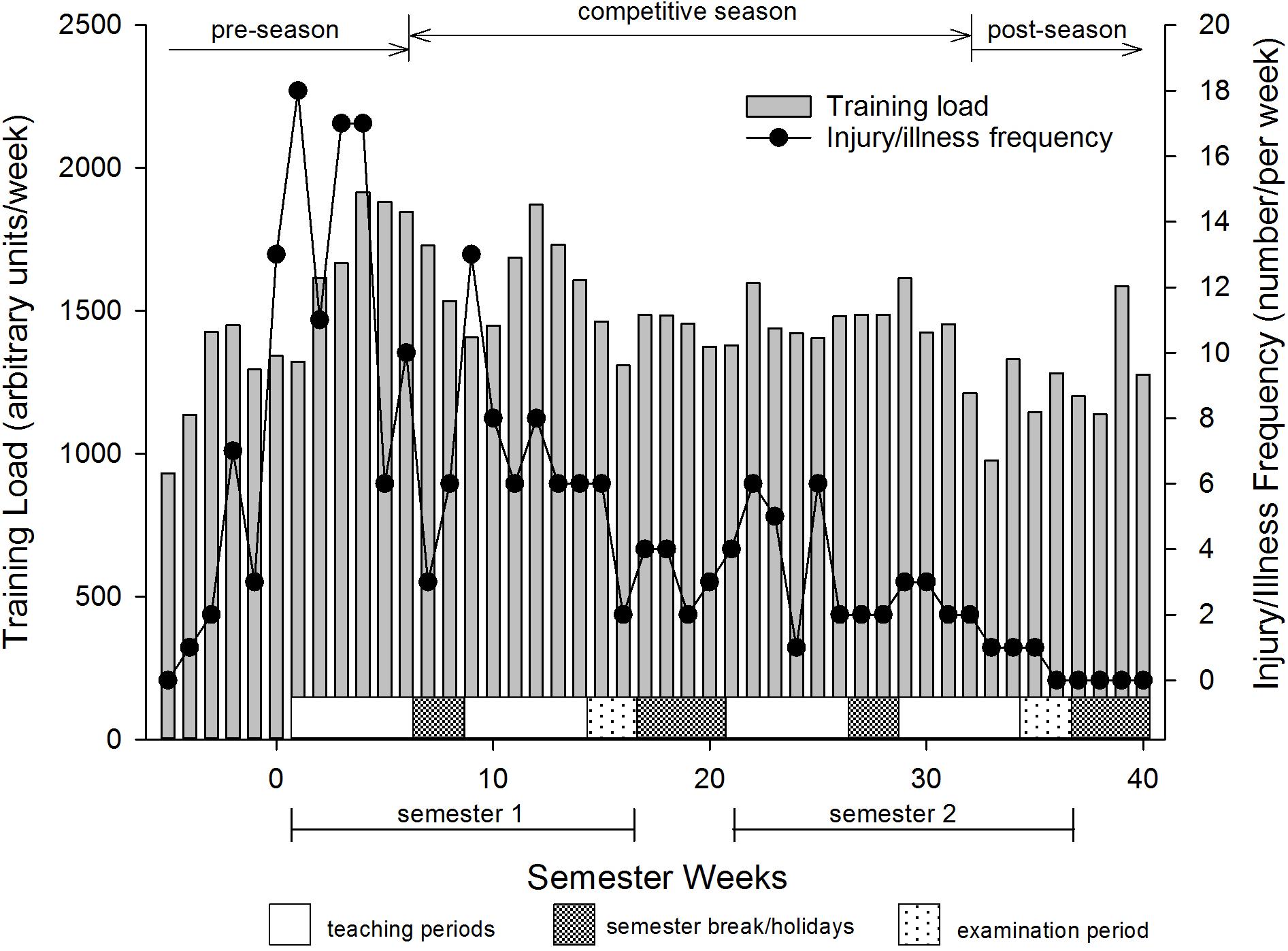

Frontiers Monitoring Training Loads And Perceived Stress In Young Elite University Athletes

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For