2023 unemployment tax calculator

Unemployment benefits or income. 2022 Marginal Tax Rates Calculator.

New Employer Ui And Construction Employer Tax Rates For 2022 State Of Delaware News

The Minnesota State Tax calculator is updated to include.

. The latest Federal tax rates for 202223 tax year as published by the IRS. 1 online tax filing solution for self-employed. Taxable social security income.

The total of the experience tax and the social tax cant exceed 6. Want to find out what you can save quickly check out our Subsidy Calculator. Terms and conditions may vary and are subject to change without notice.

Taxable portion of Social Security income. Like with most taxing guidelines there are exceptions about making estimated tax payments. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States.

You only have to answer the survey once to unlock the tax calculator for 24 hours. Enter your filing status income deductions and credits and we will estimate your total taxes. Base Period wages typically establish monetary eligibility for Unemployment Compensation UC.

Americas 1 tax preparation provider. Unlike the alternate base period the regular base period doesnt use lag quarter wages. Self-Employed defined as a return with a Schedule CC-EZ tax form.

The Regular Base Period comprises the first four of the last five completed calendar quarters preceding a claims effective date. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. MedicaidCHIP eligibility will be updated when the new Federal Poverty level data is published in early 2023.

Please note this calculator is for the 2022 tax year which is due in April 17 2023. Below are the 2022 Federal Poverty Guidelines that went into effect in early 2022 the ones you use for 2022. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

For the 2022 tax filing season individuals must file their tax returns by April 18. Unemployment compensation and alimony. 1040 Tax Estimation Calculator for 2022 Taxes.

075 for 2023 085 for 2024 and 090 for 2025. The extended deadline for 2022 is. 2022 unemployment tax rate calculator xls 2022 unemployment tax rate table pdf 2020 unemployment tax rate FAQ.

The 2022 Federal Poverty Guidelines Used in 2023. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. If you cant meet this years deadline youll need to file an extension.

Updates to the Colorado State Tax Calculator. Updates to the Minnesota State Tax Calculator. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Tax calculations allow for Tax-Deferred Retirement Plan. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Calculating 2022 Marginal Tax Brackets for IRS Payments Due April 17 2023.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. The following updates have been applied to the Tax calculator. 2023 for income earned September 1 - December 31 2022.

In all other years the flat social tax is capped at 122. Start filing your tax return now.

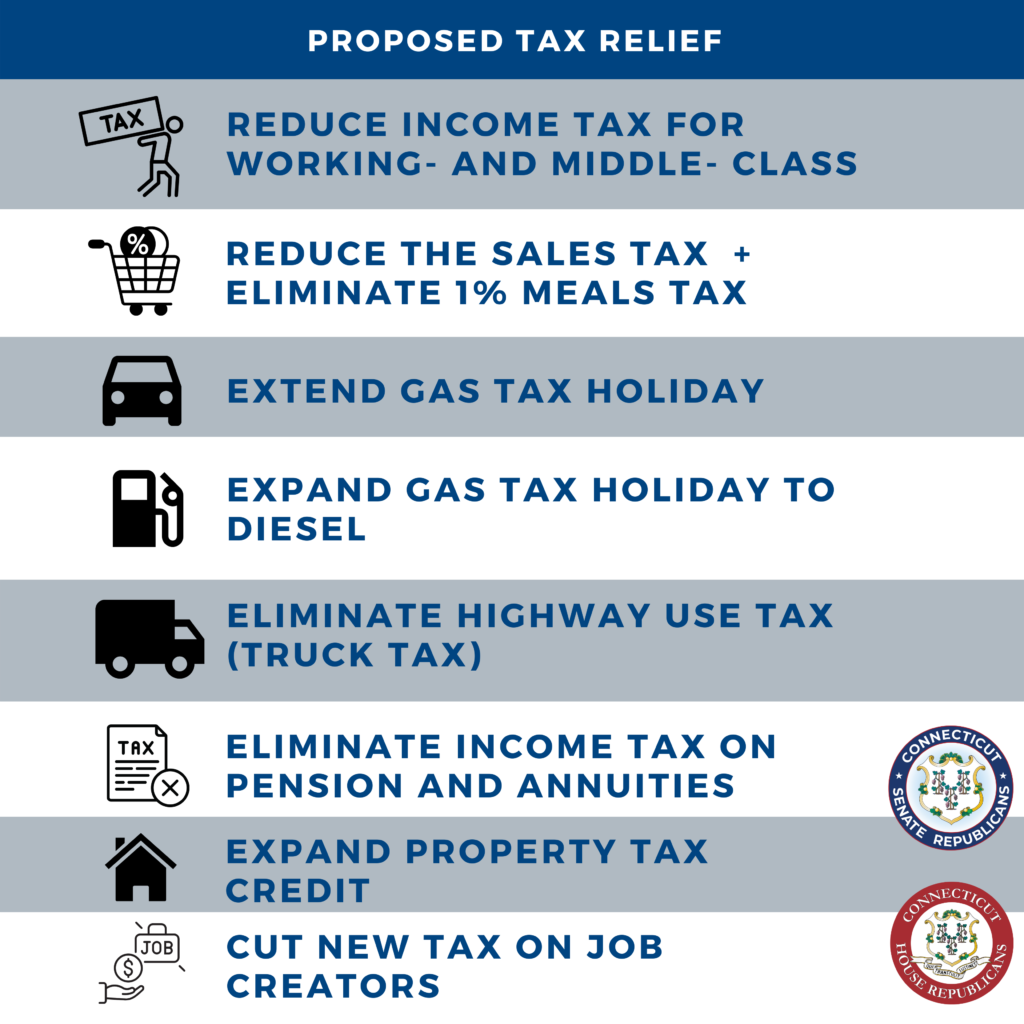

Ct Republicans Offer 1 2 Billion Tax Relief Plan For Working And Middle Class Families Connecticut Senate Republicans

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

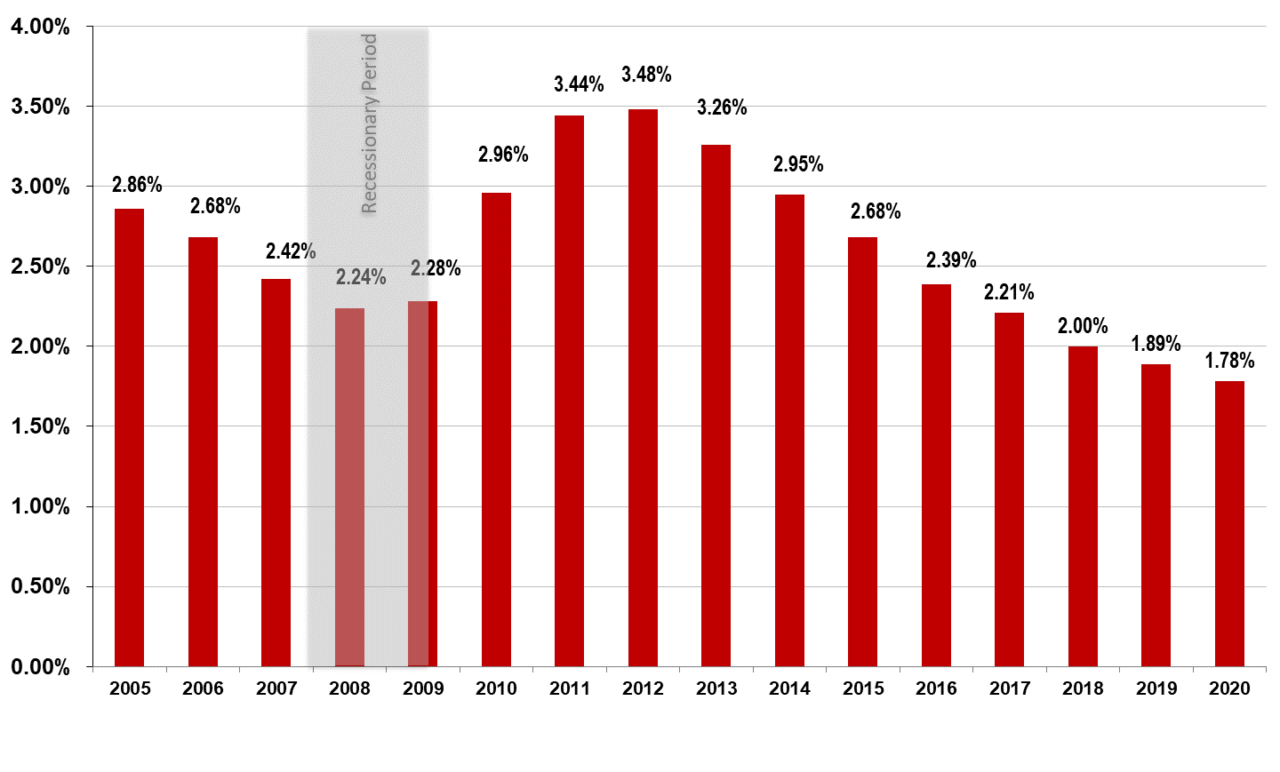

Unemployment Insurance Taxes Iowa Workforce Development

When Are Taxes Due In 2022 Forbes Advisor

Explainer On The Unemployment Insurance Trust Fund And Taxes Idaho Work

Federal Unemployment Tax Act Futa Rate For 2022 Pay Stubs Now

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

View All Hr Employment Solutions Blogs Workforce Wise Blog

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Federal State Payroll Tax Rates For Employers

Uj Crpdolmbtdm

Explainer On The Unemployment Insurance Trust Fund And Taxes Idaho Work

2